Project Description

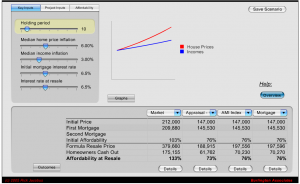

This general purpose educational tool was designed to help community leaders understand the relative performance of different limited equity resale formulas. So much of what sets one model apart from the other is dependent on the assumptions you make about interest rates, home price inflation and income growth. This tool allows a side-by-side comparison between several models, and allows you to change these input assumptions and immediately see changes in the relative performance of each of the models in terms of both ongoing affordability and equity building for homeowners. The tool also allows you to look up historical data on home prices and median incomes for every metropolitan area in the country in order to get a better feel for what appropriate assumptions might be going forward.

The tool compares several of the most common resale formulas including a basic AMI index, an appraisal based formula, a mortgage based formula and a shared equity loan model.

The tool is intended to help policy makers to evaluate questions like:

· When housing costs are rising rapidly, which approach preserves affordability best?

· Which approach provides the greatest asset building opportunity in the face of rising interest rates?

· If incomes grow more slowly than we expect, which approaches will be most impacted?

You can make the analysis more relevant to your local conditions by customizing a number of background assumptions like cost of production for a new affordable unit, the level of subsidy available, and the monthly housing costs that homeowners will face.

The web based version of the tool is no longer available.

The latest version of the tool is an interactive Excel file. The file allows users to update key assumptions and then interactively compare multiple resale formulas. The tool includes 8 commonly used shared equity resale formulas and 5 custom models which can be modified to match existing or proposed local program designs. The excel version also allows the user to save up to 5 alternative economic scenarios to understand how the formulas perform under different potential futures (ie. rising interest rates, falling home prices, etc.) The tool is locked so that it is safe for inexperienced users to play with alternatives but designed to allow power users to make small or large modifications. The excel file is released under an open source license which allows for free sharing and modification.